Credit card statements can be confusing. The conglomerate of numbers and unfamiliar terms may tempt you to ball up your statement and throw it in the nearest wastebasket each month.

But what if we told you that learning how to read your monthly merchant statement could help your business grow? Would you still toss it aside, unopened?

Key Takeaways You Will Get From This Article

- Review your chargebacks, it is one of the easiest ways to spot potential fraud; in fact, studies have shown that 71% of chargeback disputes are categorized as fraud. Your merchant statement can help you identify these issues.

- Your merchant statement can help you analyze your credit card processing fees and make sure your provider is not overcharging you.

- Keep track of what you pay in processing fees and review your rates annually. With minimal chargebacks, you may be able to renegotiate your rates.

- Keep your merchant number handy, if you ever need to call your provider for customer service, you will need this number to identify your account

The truth is your monthly merchant statement includes essential information that can help you make better business decisions.

For example, your statement can help you catch any chargeback activity early and have a better chance at keeping that money in your business. Or, with a few calculations, you can start to understand if you are overpaying for payment processing.

To help you understand these and other aspects of your merchant statement, we’ve put together this comprehensive guide – How to Read Your Merchant Statement & Why It’s Important. Keep reading to learn everything you need to know about this essential monthly document.

Table of Contents

- What is a Merchant Statement?

- Why It’s Important to Review Your Statement Every Month

- How to Read Your Merchant Statement

- Access Information Online Anytime with a Merchant Portal

What is a Merchant Statement?

A merchant statement is a comprehensive document that lists all transactions, sales activity, and processing fees for a given month.

The name of this document may differ depending on your processing partner. For example, you might receive a ‘Merchant Account Statement’ while your neighbor business receives a ‘Credit Card Processing Statement’ or ‘Merchant Processing Statement’.

Regardless of its name, the purpose of this document is to keep you informed of the sales you are making, any chargeback activity on those sales, and the fees you are paying to your processor.

Why It’s Important to Review Your Statement Every Month

When was the last time you read through your merchant statement in detail?

We know that as a small business owner, your time is precious. Perhaps reading a summary of activities you’re already aware of seems like a waste. But trust us, it’s not. In fact, reviewing your merchant statement in detail regularly is one of the best ways to track the growth of your business.

As we mentioned before, your merchant statement includes more than a list of the month’s transactions. It also contains sales activity, including chargebacks and details of the credit card processing fees being deducted from your revenue. Tracking these two pieces of information is essential to the growth and success of your business. Here’s why:

Chargebacks

A chargeback is a customer’s claim that the product or service purchased on their credit card was not purchased by them, was purchased without their knowledge, was never received, or was not satisfactory.

Often a chargeback is due to identity theft or a stolen credit card, but not always. In fact, studies have shown that 71% of chargeback disputes are categorized as fraud. In cases of perceived or known fraud, you as the merchant can dispute a chargeback. However, to dispute a chargeback, you first have to know it has occurred.

This is where your merchant statement comes in. Chargeback activity will be noted on your monthly statement, and it is important to investigate any chargebacks that are unexpected or suspicious. Your payment processor may also send a separate letter or secure communication to notify you of chargeback activity, so make sure you open everything they send you!

Learn more about avoiding chargebacks and fighting fraud.

Credit Card Processing Fees

Your credit card processing fees are the amounts collected by your payment processor for each card transaction your business runs. It is important to analyze these fees regularly because many of them change, typically about twice per year. These changes are often small but can add up quickly if you aren’t keeping an eye on them.

To keep costs down, it’s important to analyze and understand your processing fees. One way to do this is by separating the two main cost components – wholesale and markup.

-

-

-

- Wholesale / Base Cost: Interchange fees and Assessments make up your wholesale or base cost. Interchange fees are paid to the banks that issue credit cards, and Assessments are paid to the card companies themselves. This number is fixed and cannot be negotiated.

- Markup: Your markup is any charge above the base cost. This amount is paid to your payment processor and is the only negotiable component of your total processing cost.

- Wholesale / Base Cost: Interchange fees and Assessments make up your wholesale or base cost. Interchange fees are paid to the banks that issue credit cards, and Assessments are paid to the card companies themselves. This number is fixed and cannot be negotiated.

-

-

Depending on your processing partner, the percentages charged for each of these components may be included on your merchant statement. In this case, all it takes is a simple calculation to see how much you are paying in fees each month. If your statement does not include this information or you aren’t able to calculate it, you can contact your processor and request the information.

Don’t have time to read through your merchant statement in-depth and analyze your current processing fees and rates? We can do it for you! Request a free, no-obligation merchant services cost analysis.

Now that you know a few of the reasons why it’s important to review your merchant statement regularly, let’s talk about how to read your credit card processing statement.

How to Read Your Merchant Statement

If you haven’t taken time to review your merchant statement in months, years, or even decades, that’s okay. It’s not too late to get back on track! In this next section, we’ll explain in general what to look for and how to read your merchant statement.

Please note: the layout of all merchant statements will vary by provider. The information presented here is general and intended to be used as a reference.

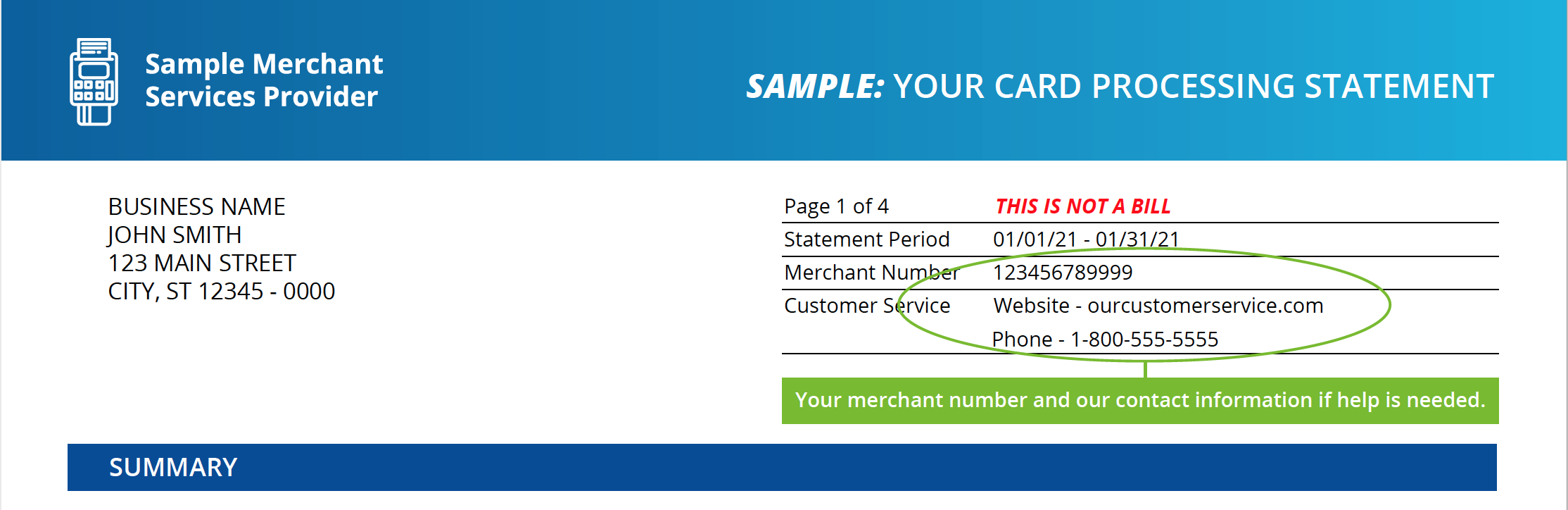

Your Merchant Number

At the top of your monthly statement, you will typically see the statement period or month, your merchant number, and your provider’s contact information in case of any questions or concerns. Make sure you keep that merchant number handy! If you ever need to contact your provider, they will likely ask for your merchant number along with your business name and address to verify your identity.

Important Information

If there is important information from your processor regarding your account or a change in operations, they will often notify you at the top of your merchant statement.

Summaries

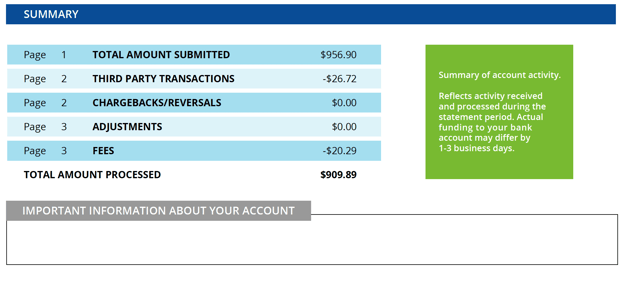

There will often be a summary of your account activity included at the top of your statement. This section reflects any activity received and processed during the statement period. The actual funding to your bank account may differ by a few business days. Typical line items for this summary section include:

-

-

-

-

- Total Amount Submitted

- Third-Party Transactions

- Chargebacks/Reversals

- Adjustments

- Fees

- Total Amount Processed (calculated from the above items)

-

-

-

Are you interested in viewing our sample merchant statement in its entirety? Click the button below to download the file!

Access Information Online Anytime with a Merchant Portal

If your processor provides it, an online merchant portal is a great tool to help you monitor the most important aspects of your business.

An innovative portal can allow you to not only view and analyze your monthly statements but quickly access key information such as:

-

-

Your merchant ID

-

Your federal tax ID

-

TIN status

-

The date your merchant account was opened

-

Equipment information

-

Your PCI-compliance status

-

At Electronic Merchant Systems, we provide our merchants with a portal that allows them to view transactions, batches, statements, and even deposit information – all online at any time.

Our portal is easily navigable and lets merchants review every key statement aspect that we’ve explored in this post so far, including chargeback information. Our merchants can also contact our 24/7/365 customer support team by sending a quick email from within the portal. We also provide PCI compliance information and assistance to help every merchant build their business to the highest card security standards.

We hope this guide has helped you understand the value of your monthly merchant statement and the importance of partnering with an innovative payment processor. Learn more about processing payments with Electronic Merchant Systems today!

To read more about how payment technology can serve your business, check out these blog posts:

Accepting Payments in the Digital Age | What You Need to Know

How to Choose the Right Point of Sale Solution for Your Retail Store

How the Right Merchant Services Products Can Help during COVID-19

-

Sources: Merchant Chimp, Payment Depot