Payment Processing Solutions for All Business Types

At Electronic Merchant Systems (EMS), we believe the payment process should be simple for customers and seamless for you. However, there are so many different ways to process payments, that it can be overwhelming to choose the best option for your business. That’s where we come in. Trust the payment experts at EMS to help you find the right solution!

Your Unique Solution

Get Exactly What You Need

We’ll tailor a local payment processing setup to your specific needs and provide tools you can use across your business to save money, streamline operations, and drive sales.

Mobile Processing

Accept Credit Cards Wherever You Are

To run a business in the United States today, one thing is abundantly clear. You need to be equipped to accept credit and debit cards. But what if you don’t have a typical storefront or space for a credit card machine? If this is the case, you need a mobile processing solution. You need EMSmobile!

Virtual Terminals

Process Secure Online Payments

It’s important to meet your customers where they are, and today, they’re online! Equip your business with a virtual terminal solution and allow your customers to place orders or make payments online. Plus, take advantage of advanced features designed to help you streamline your business.

Your Passion, Our Mission

Empowering Businesses Like Yours Since 1988

95%

See significant savings with a rate review

100+

U.S. cities have an EMS presence

30+

Years operating as a leading payments provider

11

Regional sales offices across the country

1,000+ Google Reviews | 4.7-Star Rating

Here’s What Our Customers Say:

“EMS has been a pleasure to work with. Always providing great customer service. Our representative is always available to assist and as a small business we appreciate that.”

AME Loyal Inc

“I have had great service from EMS. I recently had a hardware issue that they were excellent to deal with and immediately got my issue resolved.”

Brian P.

“Tech support has always been available and takes care of a problem in one call. Had the system for many years now and only called for help 4 to 5 times. Great system and support.”

Brita L.

Get Started Today

-

Build Your Plan

We’ll work closely with you to gain a true understanding of your business and tailor a payment solution to fit your unique needs.

-

Implement & Save

Once we’ve built your solution, we’ll continue to work alongside you to get everything up and running. Then, it’s time to watch your savings grow!

-

Receive Ongoing Support

If you ever need us, all you need to do is call or email. Our live, US-based Customer Support Team is standing by 24/7/365 to assist you.

Get The Payment Processing Your Business Needs

-

A payment processor is an important part of the financial infrastructure of a business. The processor helps to manage payments and transactions for a company. This article will cover what a payment processor does, how they work, and some of the kinds of processors to think about when choosing a provider.

-

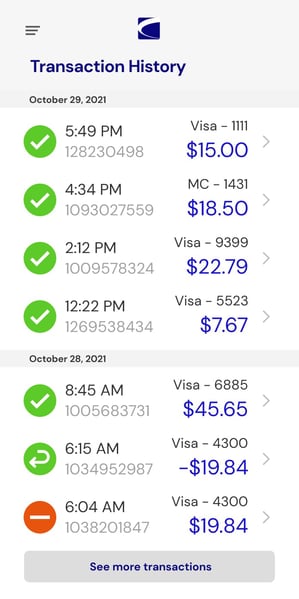

The payment processor acts as a mediator between the merchants or business owner and the financial institutions to manage credit card transactions. The payment processor can authorize transactions and facilitate funds transfers. Several types of services are provided by processors, including equipment for accepting payments via credit card data, security solutions, and PCI compliance assistance. They also offer customer support and other value-added services within just a couple of business days.

Also, the payment processor checks for security measures like ensuring that customers' card information is correct. Fraudulent acts can sometimes occur, and the payment processor's responsibility is to make sure that this doesn't happen.

Businesses use a payment processor to handle card payments' back-end logistics. It transfers card data from customers' taps, swipes, or inputs to the payment networks (such as Visa, Mastercard, Discover, and American Express) and banks involved in the transaction.

The payment processors send the data to the parties mentioned above (i.e. you, the customer and the customer's banks, and your bank). Payment processors often provide merchants with the equipment they need to process card-based transactions. They also help businesses open merchant accounts.

-

Adaptability to Business Growth

Businesses like yours can rely on top payment processors to help them keep up with rapid changes in the payments market. Fully-service payment processors can partner with businesses at all stages of their growth.

Many third-party services that bundle or resell payment processing are made for small businesses in the early stages. Leading payment processors are able to help your business grow, whether you're an entrepreneur or a large enterprise.

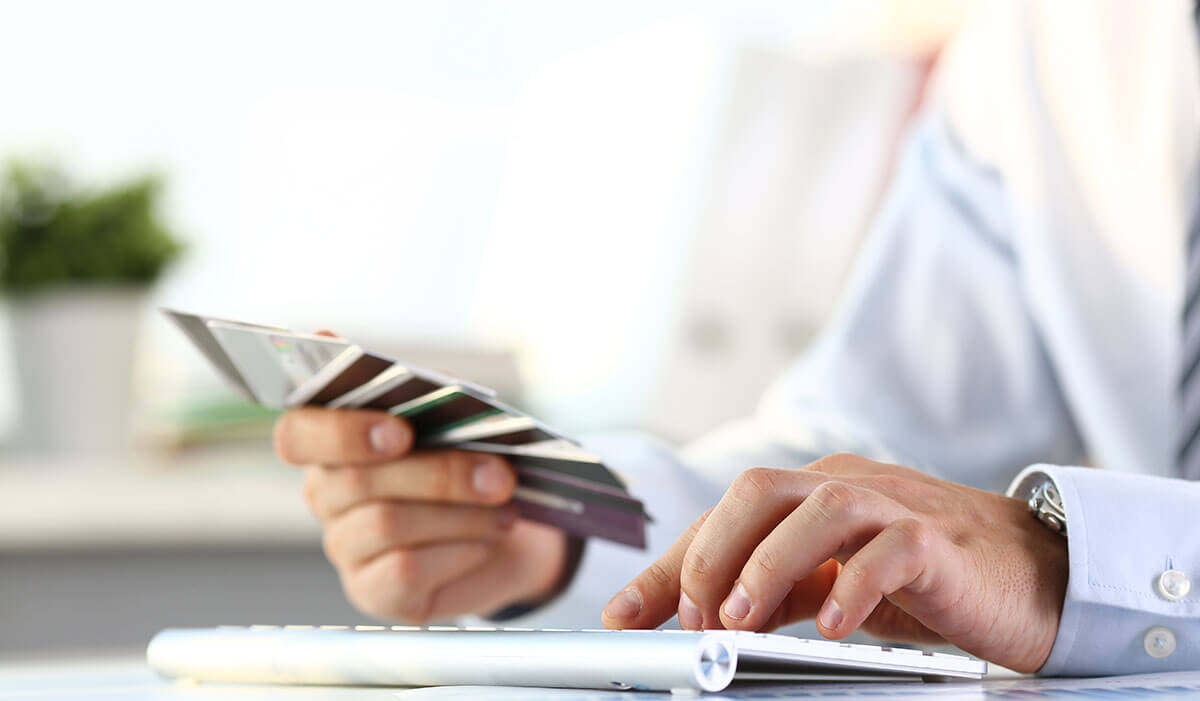

You Can Accept Credit Cards and Debit Cards

Payment processors offer the first and most important benefit of processing debit and credit card payments. Although this may seem obvious, consider how your business could operate if you were unable to accept card payments.

For businesses to be successful, reliable payment processing from a trusted credit card processing company like EMS is a must.

Provide Alternative Payment Options to Your Customers

Customers want choices, especially when it comes time to pay. While credit and debit cards are important, they are not the only payment option. Consumers today want to have a variety of options, including mobile wallets and paying with their smartphones.

Payment processors can help businesses choose the right payment options to best serve their customers. If your customers are in-person, than having a payment terminal that accepts chip, swipe, and NFC is crucial. On the go? Mobile payment processing is essential. EMS also offers payment gateways so you can sell online.

The way you connect with your payment processor will determine whether or not you are able to offer the payment options your customers desire. You should take the time to learn about all options before making a commitment, regardless of whether you are working directly with a processor or through third-party.

-

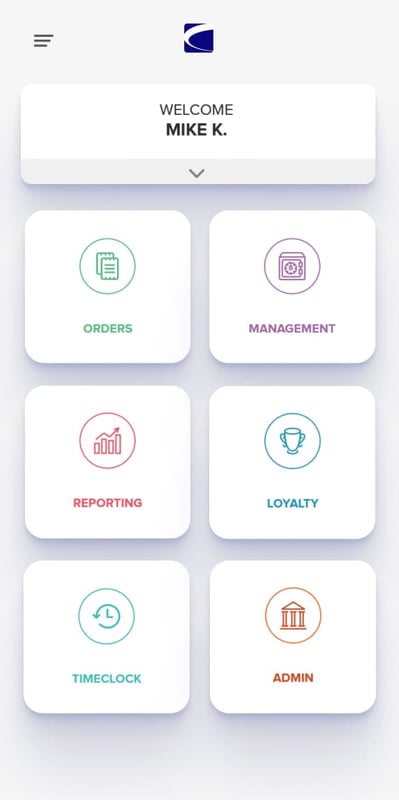

There are a lot of companies offering payment processing services, but you want to choose the best of the best. Electronic Merchant Systems offers every type of payment acceptance you need - POS systems in-person, online payments, payment gateways, mobile payment processing, and more.

You also need a trusted payment processor. Online transactions can be risky if you don't have safe solutions. EMS has been a certified level 1 PCI provider for over a decade.

Whether you need a mobile card reader or help setting up gift cards and a loyalty program, EMS offers 24/7/365 support and complete transparent pricing.

Check reviews, too! EMS has over 1000 Google Customer reviews.