Start Accepting Credit Cards for Your Small Business

by Samantha Hubay | Aug 14, 2019 | featured, Small Business | 0 comments

Are you making it easy for our customers to find you, visit you, and most importantly, pay you? If you currently don’t accept credit card payments, it’s time to start. Allow us to explain why.

In 2019, we live in an age of convenience. There are robots that can clean our floors, turn lights on and off, watch our pets when we’re at work, and even lock the front door if we forget. Not to mention, we can find the answer to almost any question just by saying “Hey Google”, “Alexa”, or “Hey Siri”. How is your business competing?

Table of Contents

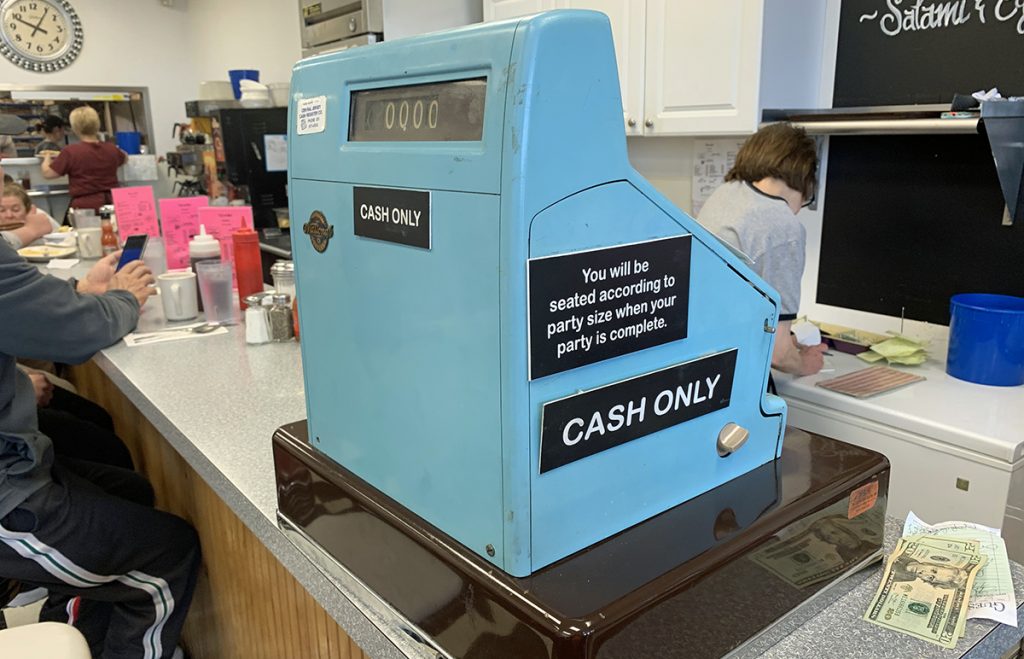

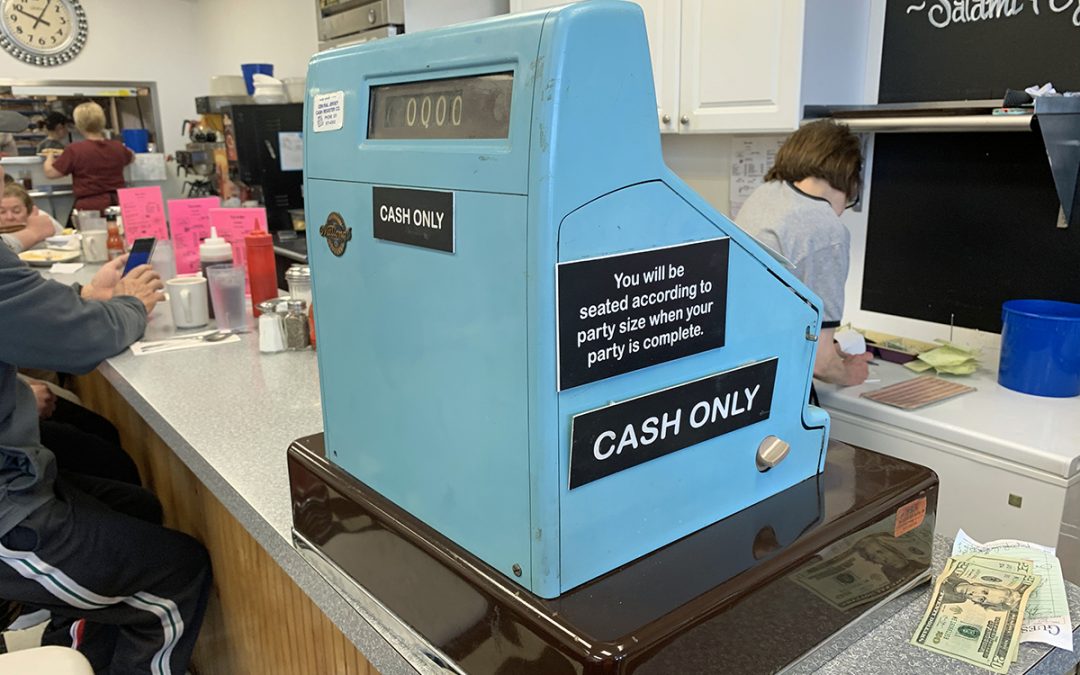

Credit Cards are Convenient, Cash is Cumbersome

Many of today’s buyers don’t carry cash. Why is that? Well, most transactions today are conveniently electronic. There’s not much reason for consumers to go to the bank, unless they need to deposit the jar of coins they’ve been filling for a vacation fund or apply for a loan. Most paychecks are direct deposit, and internal transfers can be completed online in seconds. Not to mention, dealing with cash can be cumbersome. We’ve all experienced that juggling act at the counter. Taking your change and receipt while simultaneously grabbing your purchase and trying to stuff that cash back into your wallet; and at the same time the person behind you is eagerly waiting to check out… It can make the final experience in a store an unpleasant one. And, no one wants that! You want customers to feel that they had a pleasant, convenient experience in your shop – one that will encourage them to return.

Another possible reason buyers carry less cash could be because there’s no way to lose it. If you misplace your wallet with a credit or debit card, you can easily cancel the card and order a new one. However, if you misplace a wallet full of cash, it’s likely that you’ll never see that money again.

Five Reasons to Leave Cash-only Behind

In some cases, there are businesses that don’t need to accept credit cards because they have enough business already. This typically means that they’re selling a product or service that is in high demand and are completely satisfied with their sales volume. An example of this type of business could be a cash-only homemade ice cream shop in a popular summer tourist spot. However, if you feel that your business could use more sales, you should consider accepting credit cards.

There are plenty of reasons to start accepting credit and debit card payments. One, as we mentioned before, is to improve customer convenience. Here are five more reasons that directly affect your business:

- Improved Security

Being a cash-only business means you’ll have large amounts of cash on hand at the beginning and end of the day. This opens you up to a higher risk for theft, which can decrease when you start accepting cards.

- Increased Opportunities

Studies have shown that credit cards actually do make consumers spend more money. In fact, an MIT study showed that customers are willing to spend 100% more when using a credit card.

- Decreased Risk of Employee Theft

When there’s a wealth of cash flowing in and out, employees can be tempted to “skim a little off the top”. By accepting cards, you reduce the amount of cash that you need to have on hand and reduce the risk of an employee pocketing a few dollars when the cash drawer opens.

- Improved Accounting Processes

Payments accepted via credit card have a detailed paper trail that cash payments do not. This makes it easier for you to confidently reconcile accounts at the end of the business day.

- Decreased Risk of an IRS Audit

Cash-only businesses are at higher risk for an IRS audit, simply because it’s easier to evade income taxes when there is no paper trail of your transactions. This means you need to stay impeccably organized and make sure your employees are properly counting change. The reports and tracking available with credit card tracking make it far easier to stay organized and prepared for an audit.

Start Accepting Credit Cards Today

Accepting credit cards benefits your customers, but it also benefits you. Electronic Merchant Systems offers multiple payment processing options so you can enjoy increased security, complete transactions easily, and improve the way you manage your business.

Start enjoying simple payment acceptance with a credit card point-of-sale (POS) terminal. Our countertop POS terminals allow for credit and debit card acceptance and can handle checks, EMV, EBT, gift cards, and loyalty cards. Benefits include:

- Accept chip cards and mobile wallet payments

- Enjoy fast, convenient checkouts

- Enhanced payment security

- Mobile Payment Solution

We like to think of EMS Mobile as the small business lifesaver. This simple yet powerful point-of-sale solution allows you to accept card payments with your phone or tablet. Our card readers connect to your device via Bluetooth for easy swiping! Benefits include:

- Compatible with any Android or iOS device

- Long-lasting battery life

- Accepts all major payment types

If you’re ready to take your payment processing to the next level, a complete point-of-sale (POS) solution may be right for you. The systems available with MaxxPay™ are ideal for small businesses and restaurants and come in three different options, so you can choose the best fit for your business. All of our POS systems are high-quality and incredibly cost-effective. They offer helpful reporting and an easy-to-use interface – the perfect all-in-one payment solution for your business! Options include:

- MaxxPay™ Premier

- MaxxPay™ Pro

- MaxxPay™ Mini

What’s Next?

Neither credit cards nor cash are going away. If your small business is still cash-only, consider implementing a credit card processing solution today! Electronic Merchant Systems offers various processing options and additional services for growing your business. Contact us today if you’re ready to start accepting credit card payments. We’ll help you choose the best option for your small business.

Shopping Cart

No products in the cart.